Food costing is the most important aspect of running any food business. You can have to fanciest café/restaurant with the best service but if the products you are selling are not making money, you’re wasting your time.

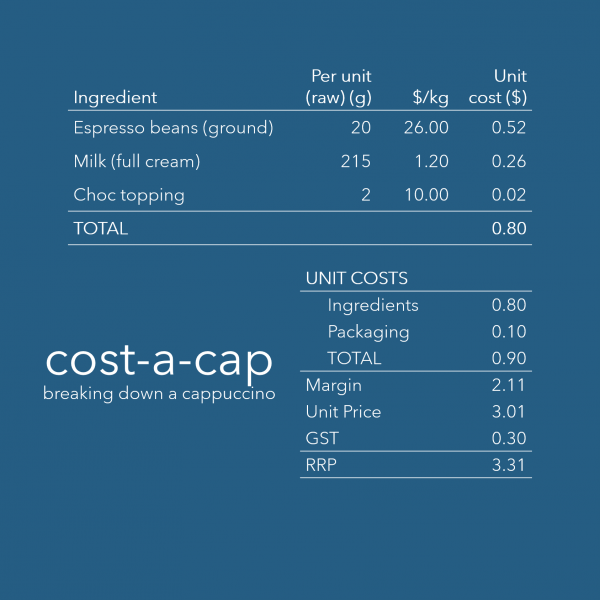

By way of an example, let’s break down the cost of a café staple – a small (8oz) cappuccino – and draw some points.

1. Weights

There are different weights to consider in food costings; raw, prepped and cooked weights. Here, we use espresso beans which have been ground (20g) into your group-head so we’ll called it a prepped weight.

2. Unit price

In this example we work off a COGS margin of 30% (this implies the gross margin is 70%). So, the unit price equals total unit costs divided by 30%. Margin is the difference between the unit price and total unit costs.

3. RRP vs. actual price

RRP reveals the final price required for your target margin to be achieved. But, ultimately, you should price your product on what you think your customers are willing to pay (i.e. the actual price).

Admittedly, you have less freedom to do this when it comes to a more standardised product such as coffee, so checking out your competitors pricing is important. In any case, costing your products is an important first step and benchmarking exercise, the actual price you set might be higher, say, $4.00.

4. Finer details

The more detail the better! Costings should be as accurate as possible so you can really understand your margins. Your product costs should also include some margin for waste and transaction costs.

5. Labour cost?

Where are wages? A unit labour cost can be estimated and added to the costing. However, it is better to set a target % and analyse total wages against total revenue as it appears on your P&L statement.

For example, you may set a target wage (incl. super) to total revenue ratio of 25% (check industry standards and look at your historical records). See our post on wage budgeting HERE.

If your wages are significantly higher than this (over several periods) then sales are not high enough to support your ongoing labour costs, or your products are too labour intensive. Either way, it’s time to make a change!