The looming end of financial year is a time for reflection. Your business financial accounts come to mind and your accountant gets to work. So, how is your business performing?

Once your accounts are reconciled, it’s time to do some analysing. The ATO publishes some small business benchmarks as a guide to help you compare your business's performance against similar businesses in the same industry. You can find them HERE.

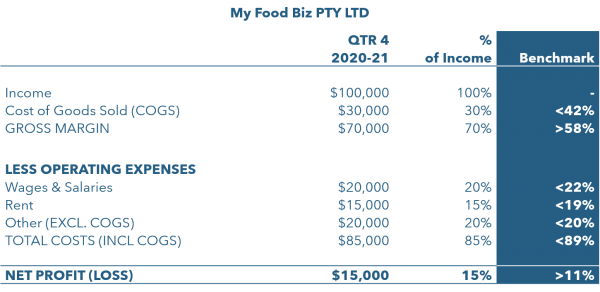

Creating a performance table, like the one presented below, is a useful exercise to do on a regular basis. In this example we use a takeaway food services business with an annual turnover between $200,001-$600,000.

The performance table groups expenses into broad categories to help you quickly compare to industry benchmarks and, if you do it over time, to your own business in previous periods.

Compared with your traditional P&L, it is easier to look at and compare over time. It also allows you to identify where broad improvements need to be made. Once these are identified, then you can drill down into the specifics of your P&L statement.

If your business performance is better than the benchmarks, that’s great but it’s not the end of the story. Your best benchmark is yourself. Continue to strive to improve on previous periods. Never stop trying to improve on your own results as that would take the fun out of running a business.